Aldermore Bank Buy to Let Calculator

Founded in 2009, Aldermore Bank is a retail bank which provides financial services to small and medium-sized businesses. The Buy to Let Calculator work came after a much larger development for the entire web estate built in Umbraco but as a discreet case study, it works well.

The Aldermore Bank Buy to Let Calculator was designed to allow landlords and intermediaries to calculate Buy to Let loans using a simple

two-step calculator.

The Business Case for the project was to:

- Increase buy to let mortgage applications;

- Increase click through to product pages from page(s) from calculators;

- Reduce complaints and enquiries;

- Improved SEO performance, as calculators are a high search term.

Aldermore Bank was one of Rippleffect’s first fully agile clients and provided a member of their team to act as a product owner who was embedded in the team. This allowed the project to be ran using Scrum principles, with a Product Owner on hand to help with backlog grooming and various ceremonies.

This meant that the client was always 100% up to date with what was going on with the project and allowed them to quickly act when looking at the priority of work we were undertaking, or help clarify any functional areas which came up.

As a Scrum Master, this took the pressure off me to focus on getting the team to deliver a high-quality product and it stopped the developers and testers from trying to second guess what the functionality was by relying on heavy documentation.

All functionality was written as simple user stories so the client and the team could easily understand what was expected. Technical additions were made the tickets in JIRA for any API endpoints etc along with acceptance criteria (for the testers). Holistically the tickets were separated into high-level Epics e.g. compliance, end-user, admin user, tracking etc. For example “As a user, I should be shown the maximum amount I can borrow”

The project was delivered on time and to budget and completely removed the ‘ta-dah’ moment, as during sprint review the Product Owner could see a finished iteration and feedback any issues (or make changes to the backlog) every two weeks.

Client List

SOME OF THE DIVERSE BRANDS I’VE WORKED WITH

Like the Above? Below Are Hands Down the Best Blog Articles You’ve Ever Read

Security Security Security

Increase Your Online Security with this Article Covid compliance forced physical shops to close and accelerated the use of [...]

Going Quantum

How to Use Amazons Quantum Computers If annealing, superposition, and qubits all sound like new Netflix films to [...]

Digital Currency: The Next Fintech Challenge?

With the likes of Dorthy Perkins and Topshop on the brink of collapse, what can governments do to stimulate spending [...]

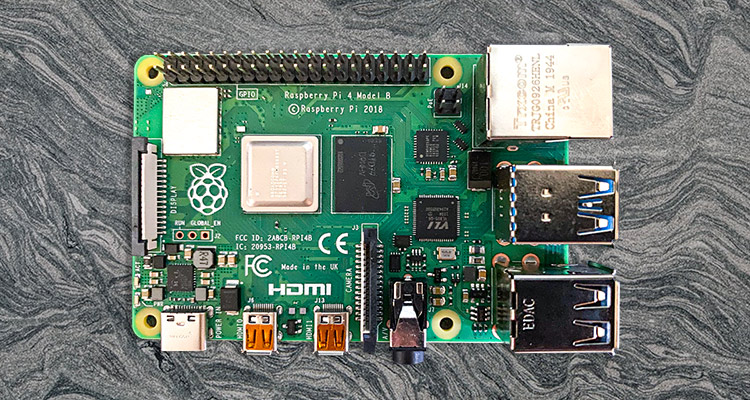

Raspberry Pi Hedgehog Camera

Raspberry Pi Hedgehog Camera Lockdown 1.0 was a golden opportunity to learn some new skills, move out of [...]

Making Meetings More Manageable

"Never ask a question you didn't know the answer too". The first rule I was taught in advocacy at law school. [...]

5 Tips for Setting up Remote Agile Teams

During the recent Maxwell Bond Webinar (kindly organised by Riana Butler) on "Agile Project Delivery" I sat as a panellist. There [...]

Don’t Test The Testers

In the last 20 years of delivery I've lost count of the number of times I've heard "No, we don't need [...]

The Grand Bore

The room erupted in laughter when my colleague accidentally had a double typo in a sprint meeting and wrote “twat” instead [...]

Using Clouds to Help the Homeless

The tech ops guys were banging on about CloudFlare again, and I had no idea why. Did Cloudflare sponsor them? Surely it [...]

Digital Disappointment

Frustration increased as my colleague prodded her greasy index finger on my Macbook Pro’s screen and tried to swipe the web [...]

When Zero Talent Counts

Getting a highly qualified candidate with the most in-depth knowledge about your company’s chosen technology is the most valuable potential employee [...]

Grammarly and Linkedin, a Perfect Partnership?

This weekend I was told by a beautiful girl in a library how to bring my “A” game when writing Linkedin [...]

Do Project Managers Need KPIs

Key Performance Indicators, they’re not something a project manager needs to worry about right? They’re just a buzzy term used by [...]

Getting Team Buy In

What's the best way to get the most out of your team? Rule them with an iron fist and push them [...]

Delphix fixes Data Gravity

The internet is rapidly growing, and it's becoming more and more commonplace just to accept that every site you use pulls [...]

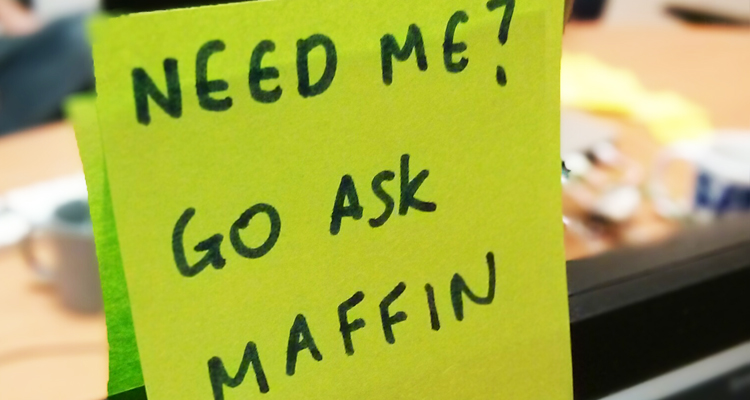

Maffins Wager

The accepted three pillars of project management are: On time, to budget and the right standard. Assuming the latter two are [...]

Failure is not an option fallacy

Many managers use the term "failure is not an option". One of the best pieces of advice I've ever heard came [...]

Context Switching in Programming

Ben Maffin People often talk about how interruptions disrupt their flow and the ability to produce good quality, consistent [...]

The XOX Method for Project Success

A common mistake made by project owners is to create a system which is either over engineered or is overly feature [...]

Live in 2 Days The MVP Conjecture

Getting a site up and running can take months or years for some companies. Can you do this quicker? What are [...]

What’s The Point to Pair Programming

Pair programming is a technique which essentially puts at least two developers on any given project at any time. So What's The [...]

Technical Debt, What is It

Technical debt is often an overlooked element of development but has far reaching implications on profit, delivery and quality of a project. What [...]

What Is Project Success

Like many questions in digital project management, this is a trickier to answer than most people initially think You'll find numerous answers, [...]